How do you usually receive payment from overseas?

If you are a blogger or an online marketer, chances are you’re using services like PayPal, Payoneer, and/or direct bank deposits. If you are, read on to learn something interesting that may help you save money.

On 1st December 2023, ShoutMeLoud will be 15 years old. It also means that for the past 15 years, I have been making money online. During the initial days, I had limited options regarding receiving overseas payments. I never worried about the “service” fees for sending or receiving funds.

Thanks to growing technology & new companies like Payoneer, Skrill, and Transferwise, I started to pay attention to these added fees.

In addition to Paypal, one of my other favorite payment services is Payoneer. They work a lot like PayPal, where you can send and receive money overseas. But what creates a difference between Payoneer & PayPal are the transfer fees.

In this guide, I will highlight some of the differences between these services and show you an example of the fees involved in one transaction done via PayPal & one done via Payoneer.

Payoneer is a globally accepted platform for sending and receiving payments. It is widely used by freelancers, bloggers ,and entrepreneurs to get paid by their clients and affiliate companies.

Payoneer vs. PayPal: Which service is best?

I started using PayPal in 2008 & Payoneer in 2013. Since then, I have consistently used both services to receive payment from the U.S., Europe, and many other parts of the world. Both services are reliable, excellent, and offer a great customer experience.

However, calling both services the same would be wrong because they work very differently.

How does PayPal work?

When you create a PayPal account, the email account you signed up with will be used for sending and/or receiving payment. You can also link your bank account with PayPal to take the money you’ve received in it and put it into your local bank account.

When you want to receive payment, you share your PayPal address with the person, and he/she can send you money to your PayPal email address. Simple.

PayPal also supports a wide range of currencies, making it easy to use worldwide.

Users (from many countries) can store money in their PayPal accounts. For example, if I send you $100, you can store that money in your PayPal account. For making future payments, you can use that $100 directly to make payment.

However, this feature is not available in many countries (like India) due to government regulations.

PayPal offers many other features, such as a payment gateway that can be used to sell stuff online, run a membership site, and do various other activities.

Check out:

- How To Send Money Using PayPal Mass Payment

- How To Export PayPal Transaction Details For Accounting Purposes

- How To Cancel PayPal Billing Agreement & Automatic Renewal

How does Payoneer work?

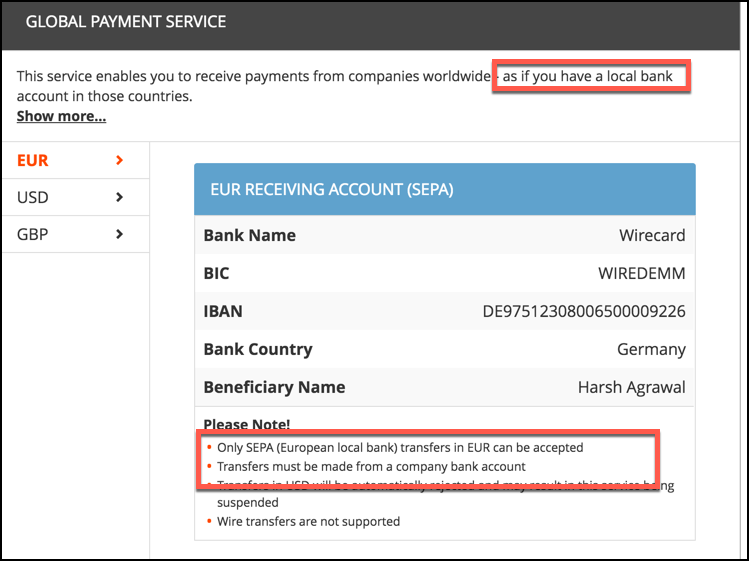

When you sign up for a Payoneer account, it will link to your local bank account. If you need one, Payoneer will give you a local bank account in the USA, Europe, the United Kingdom & Japan. When you have to receive payment, you simply share the bank account details given by Payoneer (found under your Payoneer dashboard).

One benefit of this is you won’t lose money due to multiple currency conversions.

Here’s an example:

- You are from India & you receive a payment from Amazon U.S. using Payoneer. Amazon will deposit that money in USD into your Payoneer U.S. account, and then Payoneer will transfer & convert the money into your local currency, which you can withdraw into your bank account.

The above example is crucial for you to understand, as this is one big step that helps you save a lot of money that you otherwise would lose due to double currency conversions.

Check out:

- How To Receive Amazon Affiliate Payment Using Payoneer

- How To Receive Commission Junction Payment Using Payoneer

Which service should you use? PayPal vs. Payoneer

Both of them have their advantages & disadvantages in certain scenarios. You should choose which one to use on a case-by-case basis.

Most affiliate marketing companies, ad agencies, and online services use PayPal.

In certain scenarios, when you have an alternative option to get paid using Payoneer, do the calculations and see if it makes sense.

In a majority of cases, Payoneer will help you save money.

But again, this only makes sense if Payoneer is a viable option.

Example: Receiving $2,300 from the United States (receiving in India)

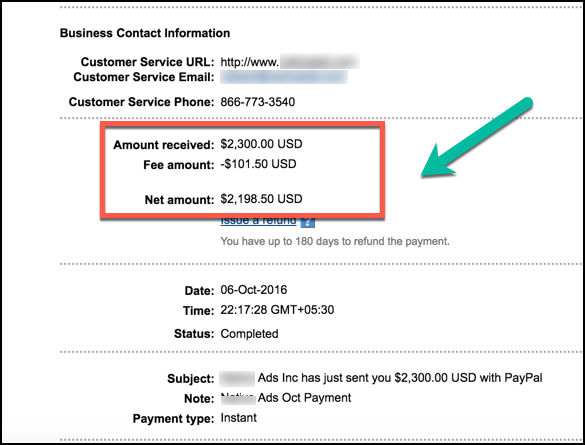

PayPal:

Every month I receive $2,300/month from a direct advertiser (detailed in our monthly income reports). Until last month, I used PayPal to receive the money. Here is the screenshot from my PayPal account:

PayPal converted USD into INR before transferring the money into my local bank account. This is where PayPal used their own conversion rates (rather than the market standard) & I ended up receiving:

$2,198.5 * 65.04 = INR 142,990

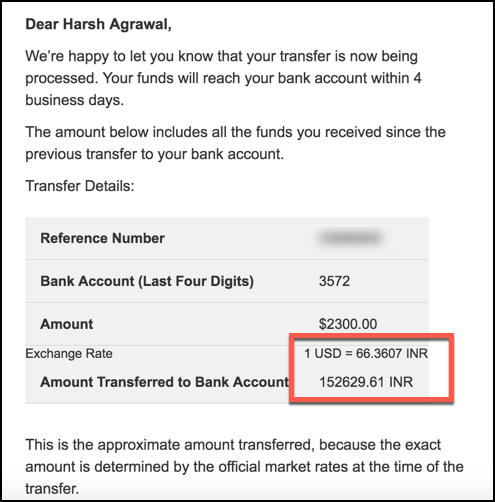

Payoneer:

With Payoneer, I received the complete $2,300 & the conversion rate was the market standard:

Amount received into my bank account: INR 152,629

The Difference:

For receiving $2,300 from the U.S. to India, while using Payoneer, I saved about $142/transaction.

In one year, that’s $1,704!

$1,700 a year is indeed a considerable amount of money that I was otherwise losing by using PayPal to receive this money.

Conclusion: PayPal Vs. Payoneer

As I said above, you should have & use both PayPal and Payoneer accounts. Whenever possible, you may want to consider using Payoneer to receive payment.

Unlike PayPal, Payoneer offers services in select currencies. If you are receiving money in USD, Euro, GBP, or Japanese Yen, you should try using Payoneer & see if it helps you to save money or not.

Create PayPal account || Create Payoneer account

In my testing, Payoneer helped me to save a big chunk of money over PayPal.

If you have the chance to switch to Payoneer for receiving and/or sending certain payments, you should not miss the opportunity to do so.

What are your thoughts on PayPal vs. Payoneer? Has Payoneer saved you money? Let me know in the comments below!

Don’t forget to share this post!

Here are a few hand-picked tutorials for you to read next:

- Top 7 Paypal Alternatives For Bloggers and Freelancers

- Payoneer Mobile App Is Pure Bliss For Freelancers & Affiliates

- PayPal Me: Easiest Way To Accept Payment via PayPal

I had been using Paypal for a long time even though I’d Payoneer too. When the Payoneer was first launched I was not sure if it’s gonna work or not. But later I found if you know how it works Payoneer is quite good. I love to buy domain names using the card’s details when by using Paypal we are not able to purchase. So, my experience is Payoneer Master Card I save approx $5 on each domain and other discounted products.

PayPal is more global than Payoneer. I’ve seen PayPal is used most of the countries around the world. Although, it’s not yet in Bangladesh. But in my eye, it is the best global payment method and it’s payout is more minimum than Payoneer. So ultimately, PayPal is the best for global citizens! What you say, sir?

Thanks

Yeah I agree, Payoneer is better than Paypal. Paypal cut more commission than the Payonner and take much time. It’s just an old brand and it does not always true that old one should be the best one.

I agree with you that Payoneer is more beneficial than PayPal. But this is also a matter of the fact that PayPal is almost universal accepted.

Also, Payoneer sometimes doesn’t allow individual payment for some account.

Payoneer is very good. I have been using a PayPal account in the USA that I bought from Auction Essistance since PayPal isn’t supported in my country Pakistan. PayPal eats a lot of fees which is why I switched to Payoneer.

Hello Harsh ,

Yes by reading this article i am agree with you .

My last payment on paypal was 1200$ in which they cut approx 100$ and in same time i received 400$ on payoneer and there is no fees by them.

Paypal has best refund policy but payoneer doesn’t .That’s the issue if i am a buyer .

Thanks

Hi Harsh! Thanks for sharing such a useful Information. It really helped me for Saving Extra Money.

Yes, i also think payoneer is far better than paypal.

I had been using Paypal for a long time even though I’d Payoneer too. When the Payoneer was first launched I was not sure if it’s gonna work or not. But later I found if you know how it works Payoneer is quite good. I love to buy domain names using the card’s details when by using Paypal we are not able to purchase. So, my experience is Payoneer Master Card I save approx $5 on each domain and other discounted products.

To be honest this is one of the best post of your. 🙂

Thanks for sharing.

Hi Harish,

Thanks for writing such an excellent detailed article about Payoneer. I have signed up for its service after reading your article. And you have mentioned that there is no charge unlike PayPal for every transaction made from Payoneer to local Indian bank (USD to INR) However, in Payoneer’s website, it mentioned that a 2% conversion rate would apply for each transaction made? Could you please clarify this confusion.

this article is very useful, after read this post I am using payoneer. thank you

Last month I sent my trough payoneer and was rejected but paypal didnt do that

I don’t find out more about Payoneer, but after reading this blog, I think Payoneer will be better when compared to PayPal. I will soon try out Payoneer soon and will share my experience too. I was searching for an alternative to PayPal. Because my online e-commerce website are facing many problems with Paypal, instantly my account got restricted, and I think this issues will overcome with Payoneer