How do you usually receive payment from overseas?

If you are a blogger or an online marketer, chances are you’re using services like PayPal, Payoneer, and/or direct bank deposits. If you are, read on to learn something interesting that may help you save money.

On 1st December 2023, ShoutMeLoud will be 15 years old. It also means that for the past 15 years, I have been making money online. During the initial days, I had limited options regarding receiving overseas payments. I never worried about the “service” fees for sending or receiving funds.

Thanks to growing technology & new companies like Payoneer, Skrill, and Transferwise, I started to pay attention to these added fees.

In addition to Paypal, one of my other favorite payment services is Payoneer. They work a lot like PayPal, where you can send and receive money overseas. But what creates a difference between Payoneer & PayPal are the transfer fees.

In this guide, I will highlight some of the differences between these services and show you an example of the fees involved in one transaction done via PayPal & one done via Payoneer.

Payoneer is a globally accepted platform for sending and receiving payments. It is widely used by freelancers, bloggers ,and entrepreneurs to get paid by their clients and affiliate companies.

Payoneer vs. PayPal: Which service is best?

I started using PayPal in 2008 & Payoneer in 2013. Since then, I have consistently used both services to receive payment from the U.S., Europe, and many other parts of the world. Both services are reliable, excellent, and offer a great customer experience.

However, calling both services the same would be wrong because they work very differently.

How does PayPal work?

When you create a PayPal account, the email account you signed up with will be used for sending and/or receiving payment. You can also link your bank account with PayPal to take the money you’ve received in it and put it into your local bank account.

When you want to receive payment, you share your PayPal address with the person, and he/she can send you money to your PayPal email address. Simple.

PayPal also supports a wide range of currencies, making it easy to use worldwide.

Users (from many countries) can store money in their PayPal accounts. For example, if I send you $100, you can store that money in your PayPal account. For making future payments, you can use that $100 directly to make payment.

However, this feature is not available in many countries (like India) due to government regulations.

PayPal offers many other features, such as a payment gateway that can be used to sell stuff online, run a membership site, and do various other activities.

Check out:

- How To Send Money Using PayPal Mass Payment

- How To Export PayPal Transaction Details For Accounting Purposes

- How To Cancel PayPal Billing Agreement & Automatic Renewal

How does Payoneer work?

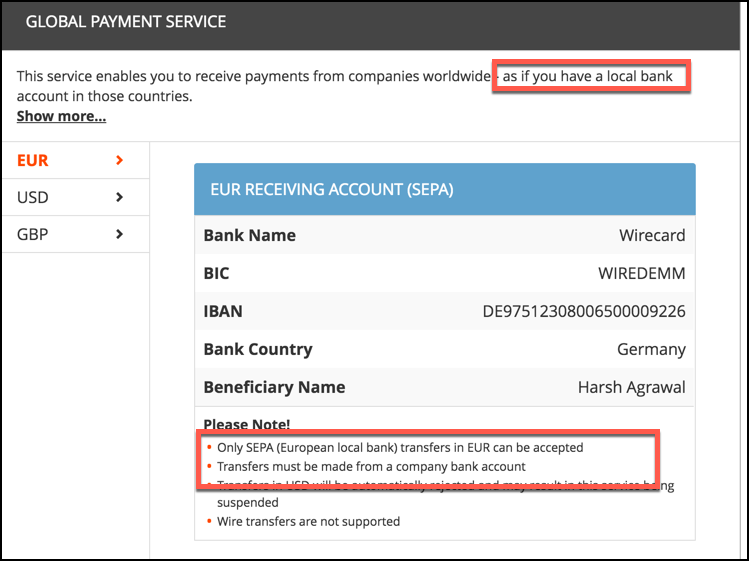

When you sign up for a Payoneer account, it will link to your local bank account. If you need one, Payoneer will give you a local bank account in the USA, Europe, the United Kingdom & Japan. When you have to receive payment, you simply share the bank account details given by Payoneer (found under your Payoneer dashboard).

One benefit of this is you won’t lose money due to multiple currency conversions.

Here’s an example:

- You are from India & you receive a payment from Amazon U.S. using Payoneer. Amazon will deposit that money in USD into your Payoneer U.S. account, and then Payoneer will transfer & convert the money into your local currency, which you can withdraw into your bank account.

The above example is crucial for you to understand, as this is one big step that helps you save a lot of money that you otherwise would lose due to double currency conversions.

Check out:

- How To Receive Amazon Affiliate Payment Using Payoneer

- How To Receive Commission Junction Payment Using Payoneer

Which service should you use? PayPal vs. Payoneer

Both of them have their advantages & disadvantages in certain scenarios. You should choose which one to use on a case-by-case basis.

Most affiliate marketing companies, ad agencies, and online services use PayPal.

In certain scenarios, when you have an alternative option to get paid using Payoneer, do the calculations and see if it makes sense.

In a majority of cases, Payoneer will help you save money.

But again, this only makes sense if Payoneer is a viable option.

Example: Receiving $2,300 from the United States (receiving in India)

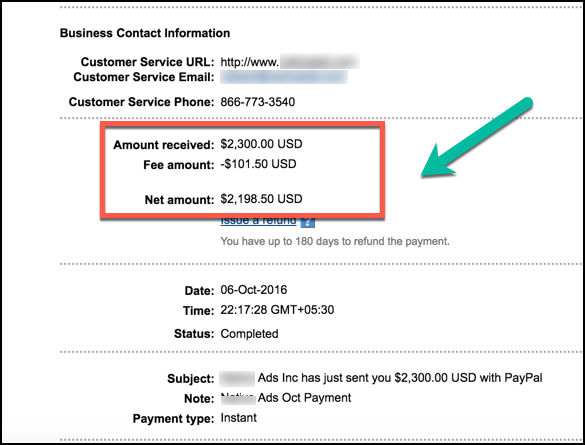

PayPal:

Every month I receive $2,300/month from a direct advertiser (detailed in our monthly income reports). Until last month, I used PayPal to receive the money. Here is the screenshot from my PayPal account:

PayPal converted USD into INR before transferring the money into my local bank account. This is where PayPal used their own conversion rates (rather than the market standard) & I ended up receiving:

$2,198.5 * 65.04 = INR 142,990

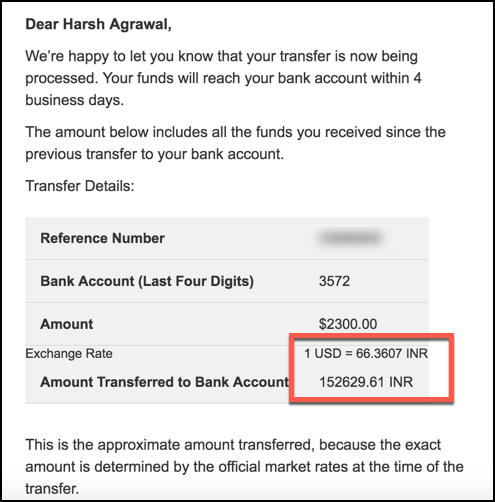

Payoneer:

With Payoneer, I received the complete $2,300 & the conversion rate was the market standard:

Amount received into my bank account: INR 152,629

The Difference:

For receiving $2,300 from the U.S. to India, while using Payoneer, I saved about $142/transaction.

In one year, that’s $1,704!

$1,700 a year is indeed a considerable amount of money that I was otherwise losing by using PayPal to receive this money.

Conclusion: PayPal Vs. Payoneer

As I said above, you should have & use both PayPal and Payoneer accounts. Whenever possible, you may want to consider using Payoneer to receive payment.

Unlike PayPal, Payoneer offers services in select currencies. If you are receiving money in USD, Euro, GBP, or Japanese Yen, you should try using Payoneer & see if it helps you to save money or not.

Create PayPal account || Create Payoneer account

In my testing, Payoneer helped me to save a big chunk of money over PayPal.

If you have the chance to switch to Payoneer for receiving and/or sending certain payments, you should not miss the opportunity to do so.

What are your thoughts on PayPal vs. Payoneer? Has Payoneer saved you money? Let me know in the comments below!

Don’t forget to share this post!

Here are a few hand-picked tutorials for you to read next:

- Top 7 Paypal Alternatives For Bloggers and Freelancers

- Payoneer Mobile App Is Pure Bliss For Freelancers & Affiliates

- PayPal Me: Easiest Way To Accept Payment via PayPal

Hello Harsh, great post man! I am wondering if Payoneer offers card services in India? You know the Payoneer mastercard? I am out travelling right now and using their service and I must say it’s really impressive. I don’t have to do all those bank transfers and whatnot. As far as I am aware, Paypal doesn’t offer such services which makes payoneer the best option imho. Also, Paypal really annoys me everytime when I have a large payment and they restrict my account, don’t have those issues with Payoneer.

Paypal is old that’s why all know about it, but happy to know the alternative of it, that’s really wonder. Thanks brother.

Thanks for explain about this topic! Currently i use payoneer really is best service.

Thanks for sharing your experience. It helped a lot.

Harsh, you’re right that these added fees are something we have to deal with. But the percentage can really add up, even if it’s a small difference – so it’s a very good idea to compare all your options.

Sir Accoding to Money Transfer Charge. Payoneer is Better than Paypal.

Thanks Such a nice Information

Really very good article. I use Paypal for my Graphic designing services.

ok.I see. they allow withdraw to bank account.Thanks for this post.Just creating an account.

I think they both work differently in different countries, i’m South Africa so Paypal tops Payoneer by the mile even though only one bank works with it.

Yet another fabolous article

Thank you very much Harsh from an blog marketer

To be honest this is one of the best post of your. 🙂

Thanks for sharing.

Well, I was confused to select the service for increasing my salaries..Your article has provided a lot of help to me..

Thanks a lot for sharing…

Wow! Great article bro! Finally found the difference between Paypal and Payoneer! Surely will go with Payoneer being a Indian we go for things which helps us to save money so that would surely work great for me!

Yeah definitely Payoneer is far better !

I have switched to Payoneer recently for receiving Amazon affiliate payments and it simply cuts down the waiting period while receiving through checks.

Both payment procesors are really good i must say as i have used them. But i must add that Payoneer has a way of simplifying online transactions asides just the reduced charges.

1. A US/EU bank account to receive affiliate/freelance payments

2. Free MasterCard that can be used worldwide

3. Fewer restrictions that PayPal

4. More user friendly than Paypal

5. Most importantly CUSTOMER SUPPORT which PayPal has none

Payoneer is good, PayPal should look forth to stiffer competitions in the market from the nearest future as they have not done so well in attending to customer satisfaction.

Thanks a lot for the comparison. I personally prefer Payoneer as their service changes are less and conversion rates are good specially .Paypal isn’t available for all countries to receive payments.

We try to process your money as fast as we can but as you know that paypal is not available in pakistan and we are not using geniune account so if you paypal suspends our account we should not held responsible for that.Our processing time is 24-48 ours.

Ah! Thank you Harsh Sir, for this information.

I have account with both PayPal and Payoneer but since I had more trust on Paypal I used to receive money with PayPal.

But from now I will use Payoneer wherever possible.

Hi Harsh,

I agree with you that Payoneer is more beneficial than PayPal. But this is also a matter of the fact that PayPal is almost universal accepted.

Also, Payoneer sometimes doesn’t allow individual payment for some account.

-Ashutosh

Great article Harsh. Paypal takes a lot of commission which is significantly visible.

Thanks for writing this article. Will sign up for Payoneer right away.